Fibrosis Consulting Support

We provide substantial support to biotech and pharma companies developing products that target fibrosis, and routinely advise healthcare investors and business development teams on individual assets, pipelines and companies, in this promising space. Our core team draws from an extensive consulting network, which has close to 40 senior consultants experienced with anti-fibrotic therapeutics. These specialists understand the intricate complexities and unique challenges present in their development and commercialization and can help you effectively navigate them. Our extensive resources in this area allow us to field project teams that precisely match the expertise needs of your project.

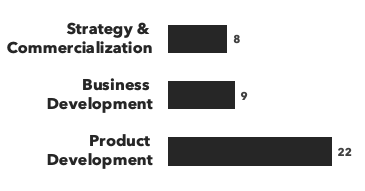

We provide support across three core areas: Strategy & Commercialization, Product Development & Business Development, across a range of product modalities.

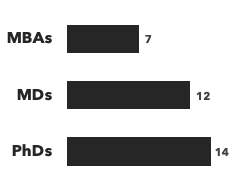

Number of consultants with fibrosis expertise, by discipline and by education:

Recent Fibrosis Projects:

- Scouting in-licensing targets in inflammation and fibrosis: A pharmaceutical company with marketed therapeutics in several respiratory disorders wanted to supplement its internal pipeline with external innovation. The company had already searched for potential partners in its home territory, but had not identified any suitable discovery/preclinical-stage assets in its indications of interest. It did not have the internal capacity to continue a search of international markets, so engaged Alacrita to identify other potential partners and assets, with a particular focus in the US and Europe.

- Building Target Product Profiles and conducting rNPV valuations of lead development assets: A clinical stage company developing small molecules to treat fibrotic diseases engaged Alacrita to quantify the value potential of their lead asset in idiopathic pulmonary fibrosis (IPF), non-alcoholic steatohepatitis (NASH), and acute respiratory distress syndrome (ARDS). The drug had completed preclinical proof of concept studies and was currently in IND-enabling studies. For each indication, Alacrita was required to build a target product profile (TPP) and a rNPV valuation of the lead asset, focusing on the US, EU5, and Japan markets.

- Interim Chief Medical Officer for fibrosis company: A well-capitalized, private biotech company with a drug discovery platform identified multiple first-in-class and best-in-class compounds targeting critical pathways widely involved in inflammatory and fibrotic diseases. As lead compounds progressed toward the development phase, the company was considering a broad spectrum of disorders as initial and follow on targets for therapy, including liver fibrotic disorders, idiopathic pulmonary fibrosis, renal fibrosis, and inflammatory bowel disease. The company desired a chief medical officer (CMO) with deep development experience in the broad area of fibrotic disease including liver, gastrointestinal, renal, and lung disease and organizational experience in the roles and responsibilities of a CMO.

- Providing due diligence in inflammation and fibrosis area: An innovation fund interested in a research institute developing proprietary mAbs against a novel liver disease target, asked Alacrita to conduct due diligence on the development of this novel target. The institute had identified a novel chemokine pathway that mediates inflammation and fibrosis, and has developed proprietary antibodies to inhibit this pathway.

We reviewed the scientific rationale, preclinical data, clinical work plan and budget for the program. We found that limited safety pharmacology variables were assessed in preclinical models, any proposal to conduct a Phase Ib in NAFLD and a Phase II in PSC within their suggested timelines was ambitious, and that more data needs to be collected on molecular profiling in patient groups prior to commencing the Phase Ib study. We also found that the clinical endpoints selected for the trials were appropriate, however additional secondary endpoints may be considered for Phase II and Phase III studies. Our recommendation to the innovation fund was that this project was worth an investment; a recommendation that was taken up. - IND-enabling studies plan for a small molecule in NASH: A biotech developing a novel drug for NASH asked Alacrita to create a project plan outlining costs and timelines for preclinical IND-enabling studies. We recommended the best animal models, such as DIAMOND and STAM, of NASH for evaluating the activity of the novel drug. We also identified the most suitable IND-enabling studies for this indication, specifically focusing on preclinical studies in module 2 of the IND which includes pharmacology (in vitro and in vivo pharmacodynamic test), ADME, toxicology, and pharmacokinetics. We also estimated the time and the cost for these preclinical studies.

- Due diligence of a first-in-class antibody in inflammatory and fibrotic orphan indications: A biopharma company required expert due diligence for a potential transaction with a clinical stage biotech focusing in inflammation and fibrosis. Alacrita was commissioned to provide an assessment of the target company's lead clinical candidate, a first-in-class monoclonal antibody in development for multiple autoimmune and liver diseases.

Alacrita reviewed all relevant company information, including preclinical publications, pharmacology and toxicology reports, clinical trial documentation and plans, CMC strategy, regulatory correspondence and IP. Together with an evaluation of the competitive landscape and market opportunity, our expert team quantified the commercial and technical risks associated with the investment. This was presented to the client as a detailed report summarizing the marketable advantages of the lead molecule with important risk areas flagged and ranked. Our client proceeded with the investment and within two years, the company was listed on NASDAQ. - For a reverse takeover, creating the business section of the investor prospectus: A biotech company focusing in fibrosis and autoimmunity was planning a reverse takeover transaction with a listed entity and required support in formulating its proxy statement (investor prospectus). Alacrita was commissioned to support the company by creating the business section of the prospectus.

- Scouting for fibroblast-associated biologics in oncology, fibrosis and autoimmune disease: A biotech company with a focus on fibroblast biology and associated therapeutics wanted to expand its pipeline by in-licensing preclinical stage assets that modulate pathogenic fibroblasts or other fibroblast-adjacent opportunities. After conducting scouting activities in-house, the company engaged Alacrita to provide additional support to identify potential partners and assets. The company was specifically seeking biologics in the early stages of development to treat inflammatory diseases, fibrosis and oncology via fibroblast-immune cell interaction driven mechanisms, fibroblast-related mechanisms or fibroblast-adjacent targets.

Selection of Fibrosis Consulting Case Studies

Challenge: A pharmaceutical company with marketed therapeutics in several respiratory disorders wanted to supplement its internal pipeline with external innovation. The company had already searched for potential partners in its home territory, but had not identified any suitable discovery/preclinical-stage assets in its indications of interest. It did not have the internal capacity to continue a search of international markets, so engaged Alacrita to identify other potential partners and assets, with a particular focus in the US and Europe.

Solution: Alacrita held in-depth discussions with the client to confirm its scouting criteria. This included defining a list of high- and low-priority indications, based on market trends, potential value and the clients' existing pipeline. In addition to this, Alacrita performed a thorough literature and database review to identify potential biological targets of interest in the fibrosis and inflammation space.

We then conducted the following tasks to identify potential partners developing assets for the indications and/or targets of interest:

Step 1: Using a combination of product pipeline databases, patent databases, literature and our established academic and industry networks, we generated lists of prospective preclinical-stage products;

Step 2: After direct discussions and data triage between Alacrita and target companies, we determined whether an opportunity was viable for introduction to the client. If so, we provided data on each shortlisted candidate for review by the clients’ scientific teams, with the result of identifying viable partnerships for co-development or in-licensing; and

Step 3: In parallel, Alacrita attended partnering conferences and meetings on behalf of the client to identify additional prospective partners.

Challenge: Our client specialised in the development of proprietary monoclonal antibodies directed towards novel targets for the treatment of immune-mediated and fibrotic disorders, including orphan indications. They had identified a novel pathway that mediated inflammation and fibrosis, and as such had developed proprietary antibodies to target it. For their lead antibody they planned to initiate a Phase IIa proof of concept (POC) repeat dose safety study in patients with Primary Sclerosing Cholangitis (PSC). This was supported by a repeat dose toxicology study conducted in mice and a Phase I, single escalating dose clinical study in healthy volunteers. In order to validate the planned Phase II study and to confirm that the supporting data would allow approval of the trial, the client wished to obtain scientific advice from the regulatory agency.

Solution: Alacrita helped facilitate interactions with the regulator in preparation for the Phase II in the following areas:

- Project management and liaison with the client and the agency

- Input into strategy, communication of mechanisms and timelines

- Review of meeting request letter

- Assistance with preparation of Draft Questions and Company Positions

- Review of briefing document

- Assistance with publishing and submission of briefing package

- Meeting preparation and attendance

- Preparation of meeting minutes and follow-up activities

The Scientific Advice meeting was a success; the trial protocol and supporting data were deemed acceptable by the agency.

Challenge: A clinical stage company developing small molecules to treat fibrotic diseases engaged Alacrita to quantify the value potential of their lead asset in idiopathic pulmonary fibrosis (IPF), non-alcoholic steatohepatitis (NASH), and acute respiratory distress syndrome (ARDS). The drug had completed preclinical proof of concept studies and was currently in IND-enabling studies. For each indication, Alacrita was required to build a target product profile (TPP) and a rNPV valuation of the lead asset, focusing on the US, EU5, and Japan markets.

Solution: After developing TPPs, Alacrita projected the addressable market considering the target patient population, market share, drug pricing, clinical development timelines and costs, etc. Using this information, we estimated potential product revenue in US, EU5, and Japan for IPF, NASH, and ARDS. We also considered the probability of success at each go/no-go development/regulatory pivotal point and the impact of that on the valuation.

For many of the input assumptions required for the valuation there was significant uncertainty, particularly given the early stage of development of this lead asset. We therefore used Monte Carlo simulation to express rNPV as a range and probability distribution. Outputs of the valuation model also included histograms and tornado plots, the latter highlighting input parameters that drive the sensitivity of the valuation.