Peptide & Protein Support

We've consulted with clients on a range of peptide & protein therapeutics, at all stages of development from discovery through to late-stage clinical, as well as advised investors on many individual assets, pipelines and companies. Our capabilities span a range of therapeutic areas and functional disciplines in the modality. Our core team draws from our Expert Network, which contains over 60 senior consultants experienced with discovering, developing, commercializing and advising on peptide and protein-based therapeutics, including providing due diligence and conducting valuations. Our extensive expert resources allow us to build project teams that precisely match the specific needs of each project we undertake.

The support we can provide ranges from opportunity mapping and business strategy to regulatory affairs, preclinical and clinical support, to due diligence, valuations and licensing, partnering & dealmaking.

A breakdown of our peptide & protein experts:

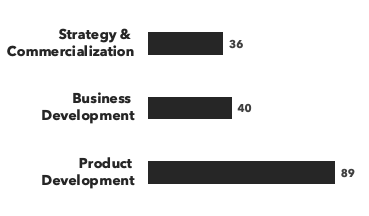

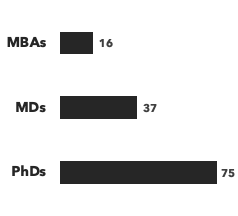

Number of consultants, by discipline and by education:

Recent peptide & protein projects:

- Providing scientific and immunological mechanism of action due diligence for a large pharma client: A major pharmaceutical company needed scientific and immunology due diligence support on a novel cyclic peptide, targeting the complement cascade system. We reviewed the scientific and mechanistic experiments underpinning the clinical program to understand the risk around a clinical study failing an efficacy endpoint. The research program and resultant data demonstrated a compelling mechanistic rationale to treat the disease and we recommend that our client should proceed from the standpoint of an immunological mechanism of action and scientific merit.

- CMC consulting for a company developing a peptide: A biotech company developing a peptide therapeutic needed CMC support with taking the compound to first-in-man studies and Phase II clinical trials.

- Technical & commercial review of anti-inflammatory peptide: A university research group had discovered a new pathway for regulation of T cell trafficking in the inflammatory response. The group had also identified an anti-inflammatory peptide and its cognate receptor which could form the basis of a novel therapeutic strategy for treatment of inflammatory and autoimmune diseases. After demonstrating efficacy in several animal models, patents were filed and the commercial opportunity was somewhat explored. The university believed the discovery represented a potential technology platform suitable for a spin-out company, and therefore had already identified an ex-industry executive and entrepreneur interested in leading such a spin-out, and had also interested VCs already. Alacrita was asked to conduct a technical and commercial review of the opportunity, as well as provide support for the development of an operations plan and an investment slide deck to support fundraising activities.

- Regulatory assessment of a generic anti-diabetic peptide drug: A biotech client had developed a generic version of a major anti-diabetic peptide drug, and wanted a clearer understanding of the product's registrability, as well as support with defining the various data packages that would be required in the submission.

- Clinical strategies for a novel peptide-based cancer vaccine: A US-based cancer vaccine company developing a peptide-based product was in clinical trials in its lead indication. Recent laboratory research had revealed the target antigens were also expressed on a number of other solid tumor types, and the company wanted to assess which of those indications were the most attractive for expanding the program.

- Pre-IND meeting support with the FDA: Our client was developing an oral form of an approved biologic drug for endocrine disorders which appeared to have excellent properties in terms of a rapid time to maximum concentration in the blood. A Phase II trial in an orphan indication was underway in the client's home country. The client also intended to submit an IND in the US to develop the drug there, and engaged Alacrita for support with a preparation and execution of a pre-IND meeting with the FDA.

- Providing reality checks on commercial opportunities: A transatlantic life science venture capital fund was contemplating investing in advanced plasma product opportunities being developed by a biopharmaceutical company, and needed a reality check on the commercial opportunities on offer..

- Due diligence of plasma protein manufacturer: A private equity investor was considering a transaction in a company supplying therapeutic proteins derived from biological sources for the treatment of numerous diseases in the neurological, autoimmune, hematological and other rare conditions. The target was a mature company operating in a well-developed sector of the industry. The PE investor commissioned Alacrita to conduct in depth technical, regulatory and market due diligence recognizing that its traditional DD providers lacked the specialized expertise and hands-on experience that Alacrita can provide.

- Valuation of novel formulation of insulin for diabetes: A preclinical stage biotech company developing a novel formulation of insulin to treat diabetes mellitus was in discussions with prospective investors for a next round of funding. To support the negotiations, the company required an independent valuation of its drug to demonstrate the potential return on investment to VCs.

- Technical, regulatory and market due diligence on a therapeutic proteins company: A private equity investor was considering a transaction in a company supplying therapeutic proteins derived from biological sources for the treatment of numerous diseases in the neurological, autoimmune, hematological and other rare conditions. The target was a mature company operating in a well-developed sector of the industry. The PE investor commissioned Alacrita to conduct in depth technical, regulatory and market due diligence recognizing that its traditional DD providers lacked the specialized expertise that Alacrita can provide.